BHP Is at Risk on Lackluster Base Metals and Coal Prices

BHP Group's (NYSE:BHP) stock has lost over 7% of its market value in the past month, accumulating to a near 10% year-to-date capitulation. Although the company is in good structural shape, weak commodity prices have created an unwanted overhang on the company's financial performance.

Two of the company's leading commodities, namely copper and coal, have felt the brunt of it in recent times, and it looks unlikely that either will recover in due course in my opinion. Additionally, iron ore prices have reverted from their early-year peaks, meaning doubts are cast over BHP's primary revenue stream.

The company's operational strength and the commodity price environment are clearly juxtaposed. Therefore, the question now is whether BHP's stock is still overvalued compared to its recovery potential; let's take a look.

Commodity price headwinds

As mentioned above, BHP's business model is heavily reliant on base metal prices, since it is a mining company. Approximately 45% of the company's revenue stems from iron ore, a commodity whose price is inextricably linked to the expected gross domestic product and global industrial output. Given the elevated interest rates across the globe and slowing core inflation, it is unlikely that iron ore will see brighter days in the near future.

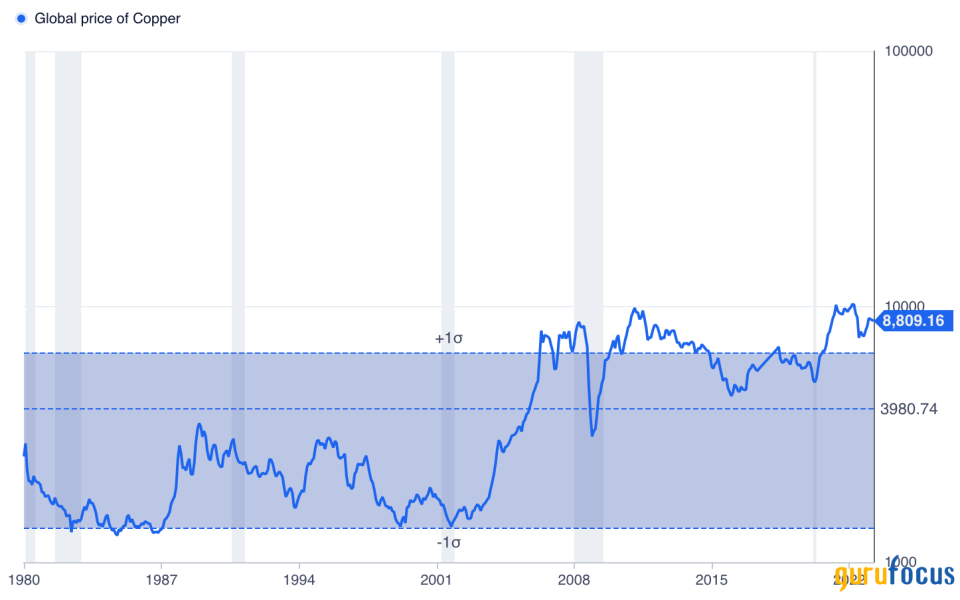

Furthermore, BHP generates roughly 25% of its turnover from copper, a base metal with similar value drivers as iron ore. Another reason copper has performed poorly in recent weeks is because of China's lackluster industrial performance, which saw the nation's PMI (Purchasing Managers Index) slip to a five-month low in May to settle at 48.8. This is important to copper and other base metals because China is considered a benchmark for global manufacturing productivity, meaning the negative results could soon be uniform across the globe.

Lastly, although the company is seeking to offload a significant portion of its fossil fuel operations, BHP generates approximately 23% of its revenue from coal. Coal prices have been in a downward spiral because of the tail risk embedded into today's macro economy. Energy prices are exceptionally sensitive to recessionary talks, which have been exacerbated recently amid events such as the failure of multiple U.S.-based banks.

Source: Markets Insider - Coal Prices (Mixed Basket)

Operational updates

Even though BHP possesses external headwinds, the company has various internal features that allow it to operate at scale throughout the economic cycle. For instance, the company has sustained an operating profit margin of 46.56% while facing lower commodity prices. Moreover, BHP continues to pay a best-in-class dividend yielding 9.65%, which shows how resilient the company is to external obstacles.

Furthermore, promising developments are unfolding within certain pockets of the company. For instance, BHP's Jansen Potash Mine has been assigned lower-than-expected stage two costs, with the company expecting capital intensity relief of $1,000 to $1,200 per metric ton. Much hinges on the Jansen Potash project as it is part of BHP's pivot into new growth markets.

Another noteworthy occurrence to consider is the pending sale of BHP's coking coal assets. The company is set to sell its stakes in the Blackwater and Daunia mines as it aims to exercise a pivot out of coal. Although coal mines performed well during the European energy crisis in early 2022 resulting from Russia's war on Ukraine, their futures remain uncertain due to the political pressure against the use of the "dirtiest" fossil fuel as well as the cyclical nature of the energy industry, which was exacerbated by the European energy crisis. A release of its coal mines would reduce BHP's cost of financing, phase out the risk of stranded assets and open the stock up to a larger investor base.

Lastly, BHP's venture capital fund has achieved early success as its investment in Lifezone Metals is set to pay dividends (figuratively speaking). According to its news reports, Lifezone has completed various offtake agreements for its Kabanga Nickel and Cobalt mine in Tanzania. The agreements are with unnamed electronic vehicle companies, leading to the assumption that the mine will deliver high-quality quartz.

In essence, BHP has sustained its robust fundamentals throughout the downward cycle of commodity prices. In addition, various positive micro factors have occurred and are yet to be fully priced by the market.

Valuation

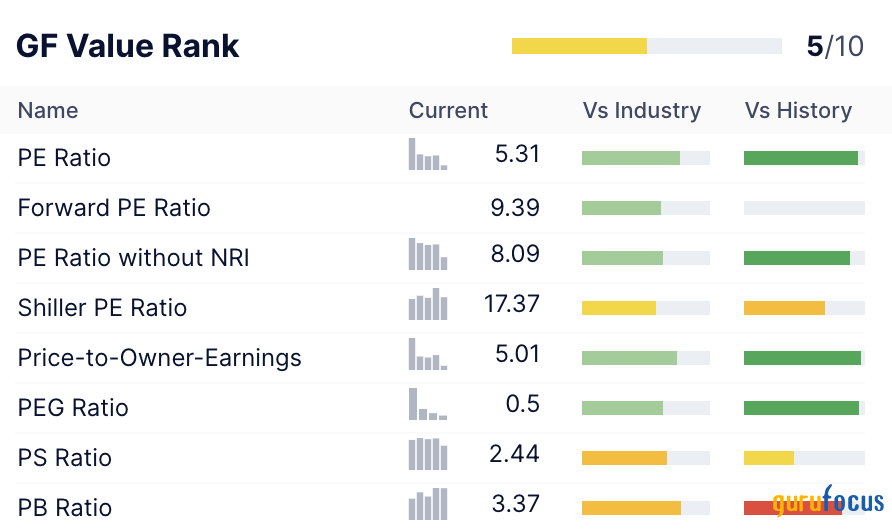

Based on BHP's current price-earnings ratio of 5.31, it can be argued that the stock is undervalued. However, the company's forward price-earnings ratio of 9.39 is higher, which is worrying as cyclical companies like BHP are always in danger of looking the cheapest right before their earnings decline.

Furthermore, BHP's price-to-tangible-book-value ratio of 3.48 is of concern. Firstly, the ratio is at a premium to historical numbers, and secondly, the company's book value could resume its deterioration if commodity prices continue to feel the pain.

Final word

All in all, I think BHP's stock is overvalued based on external events and its salient valuation multiples. Although the company has sustained lucrative profit margins while gathering positive news from micro-events, its stock's risk premiums are elevated, meaning the asset is likely to lose further value according to my estimates.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas