Bitcoin (BTC) Remains Under Pressure Despite a Bullish Tuesday Session

Key Insights:

On Tuesday, bitcoin (BTC) rose by 1.93% to end the day at $30,416. Resistance at $31,000 continued to be the key resistance level.

The upside came despite the Bitcoin Fear & Greed Index falling to 8/100, the lowest level since a March 14, 2020 low of 8/100.

Bitcoin (BTC) technical indicators flash red, with bitcoin sitting below the 50-day EMA.

The NASDAQ supported a bitcoin (BTC) rise of 1.93% on Tuesday. Partially reversing a 4.66% slide from Monday, bitcoin ended the day at $30,416.

A mixed session saw bitcoin rise to a day high of $30,744 before hitting reverse.

Falling short of $31,000 and Monday’s high of $31,296, bitcoin eased back to sub-$30,500.

The upside came despite bearish sentiment lingering from the TerraUSD (UST) and Terra LUNA meltdowns of last week.

Throughout the day, the NASDAQ 100 mini delivered support ahead of upbeat stats from the US that were also positive for riskier assets.

Several key drivers are currently in play to test investor appetite. These include the threat of a shift in the regulatory landscape, the fear of a recession, Fed monetary policy, and the risk of another stablecoin collapse.

The Bitcoin Fear & Greed Index Recovers from a 2022 Low of 8/100

This morning, the Fear & Greed Index rose from 8/100 to 12/100. While recovering from the lowest level since March 14, 2020, the Index remained deep in the “Extreme Fear” zone, reflecting the bearish sentiment across the crypto market.

While the demise of Terra LUNA and TerraUSD led to a weaker correlation between the NASDAQ 100 and bitcoin, a correlation remains in place.

Bitcoin also responded to upbeat US retail sales and industrial production figures before easing back.

Bitcoin (BTC) Price Action

At the time of writing, BTC was down 0.83% to $30,162.

A mixed start to the day saw bitcoin rise to an early morning high of $30,674 before falling to a low of $30,158.

Technical Indicators

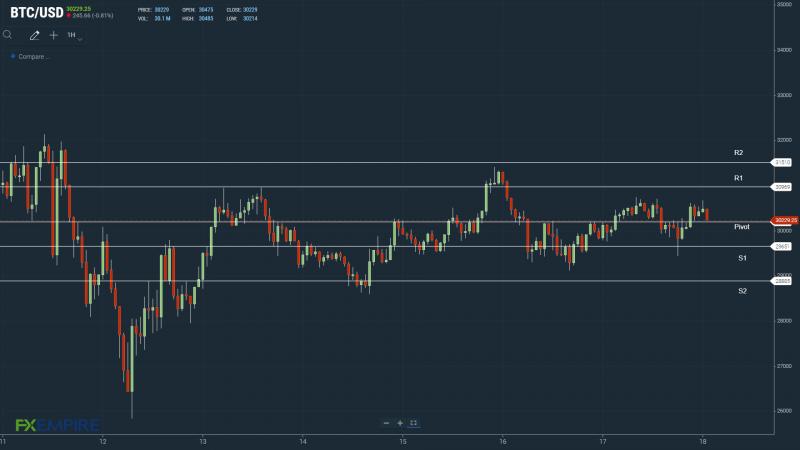

BTC will need to move through the $30,192 pivot to target the First Major Resistance Level at $30,969.

BTC would need the broader crypto market to support a breakout from Tuesday’s high of $30,744.

An extended rally would test the Second Major Resistance Level at $31,510 and resistance at $32,000. The Third Major Resistance Level sits at $32,816.

Failure to move through the pivot would test the First Major Support Level at $29,651. Barring another extended sell-off, BTC should steer clear of sub-$28,500 levels. The Second Major Support Level at $28,885 should limit the downside.

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bearish signal. BTC sits below the 50-day EMA, currently at $30,837. This morning, the 50-day pulled back from the 100-day EMA. The 100-day EMA fell back from the 200-day EMA; BTC negative.

A move through the 50-day EMA would support a run at $35,000.

This article was originally posted on FX Empire

Yahoo Finanzas

Yahoo Finanzas