Weekly CEO Buys Highlight

- By Joy Hu

According to GuruFocus insider data, these are the largest CEO buys from the past week.

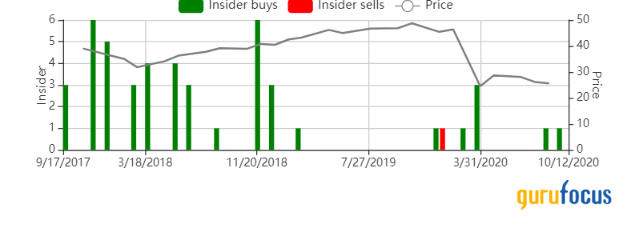

Franchise Group

Franchise Group Inc. (NASDAQ:FRG) CEO and 10% owner Brian Randall Kahn bought 149,785 shares on Sept. 15 at a price of $24.99. The share price has increased by 8.8% since then.

Franchise Group is a personal services company that provides retail federal and state income tax preparation services and related tax settlement products. The vast majority of these offices operate in the United States under the Liberty Tax Service and SiempreTax+ brand names.

The company has a market cap of $1.09 billion. Its shares traded at $27.19 as of Sept. 18.

For the second quarter, the company recorded a net loss of $21.7 million.

Kahn also bought 175,000 shares on Sept. 2 for an average price of $25.5. Since then, the stock has increased by 6.63%.

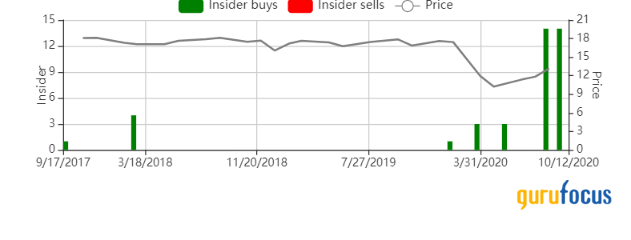

Golub Capital BDC

Golub Capital BDC Inc. (NASDAQ:GBDC) CEO David Golub bought 148,300 shares during the past week at the average price of $13.05.

Golub Capital BDC is an externally managed, closed-end, non-diversified management investment company. The company's investment objective is to generate current income and capital appreciation by investing in senior secured and one-stop loans in U.S. middle-market companies. It also invests in second lien and subordinated loans, warrants and minority equity securities in middle-market companies.

The company has a market cap of $2.25 billion. Its shares traded at $13.44 as of Sept. 18.

Net investment income during the three months ended June 30 was $35.07 million, compared to $19.41 million for the prior-year quarter.

Golub bought 7,206 shares on Sept. 3 at a price of $13.15; 106,780 shares on Sept. 8 at a price of $12.83; 128,300 shares on Sept. 10 at a price of $13.01; 10,000 shares on Sept. 14 at a price of $13.21; and 10,000 shares on Sept. 16 at a price of $13.35. The share price has increased by 0.67% since then.

Chairman Lawrence E. Golub bought 7,206 shares on Sept. 3 at a price of $13.15; 106,780 shares on Sept. 8 at a price of $12.83; 128,300 shares on Sept. 10 at a price of $13.01; 10,000 shares on Sept. 14 at a price of $13.21; and 10,000 shares on Sept. 16 at a price of $13.35. Since then, the stock has gained 0.67%.

American Assets Trust

American Assets Trust Inc. (NYSE:AAT) Chairman, CEO, President, and 10% owner Ernest S. Rady bought 45,412 shares on Sept. 14 at a price of $25.04. The stock has risen 0.48% since then.

American Assets Trust is a self-administered real estate investment trust based in the United States. The company invests in, operates and develops retail, office, residential and mixed-use properties primarily located in California, Oregon, Washington and Hawaii.

The company has a market cap of $1.51 billion. Its shares traded at $25.16 with a price-earnings ratio of 33.06 as of Sept. 18.

Second-quarter net income was $7.7 million, compared to $8.9 million for the second quarter of 2019.

Rady bought 20,000 shares on Aug. 25 at a price of $25.33. Since then, the share price has decreased by 0.67%.

Guess?

Guess? Inc. (NYSE:GES) CEO and Director Carlos Alberini bought 83,000 shares on Sept. 10 at a price of $12.05. The price of the stock has increased by 13.94% since then.

Guess? designs, markets, distributes and licenses contemporary apparel and accessories that reflect European fashion sensibilities under brands including Guess, Marciano and G by Guess.

The company has a market cap of $873.37 million. Its shares traded at $13.73 as of Sept. 18.

Net loss for the second quarter of fiscal 2021 was $20.4 million, compared to net earnings of $25.3 million for the second quarter of fiscal 2020.

Schlumberger

Schlumberger Ltd. (NYSE:SLB) CEO Olivier Le Peuch bought 25,000 shares on Sept. 14 at a price of $17.95. Since then, the stock has increased by 4.35%.

Schlumberger is the world's largest supplier of products and services to the oil and gas industry.

The company has a market cap of $26.00 billion. Its shares traded at $18.73 as of Sept. 18.

For the second quarter of 2020, net loss was $3.43 billion compared to net income of $492 million for the prior-year period.

For the complete list of stocks bought by their company CEOs, go to CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas