HarborOne Bancorp Inc (HONE) Faces Headwinds: A Look at the 2023 Earnings Report

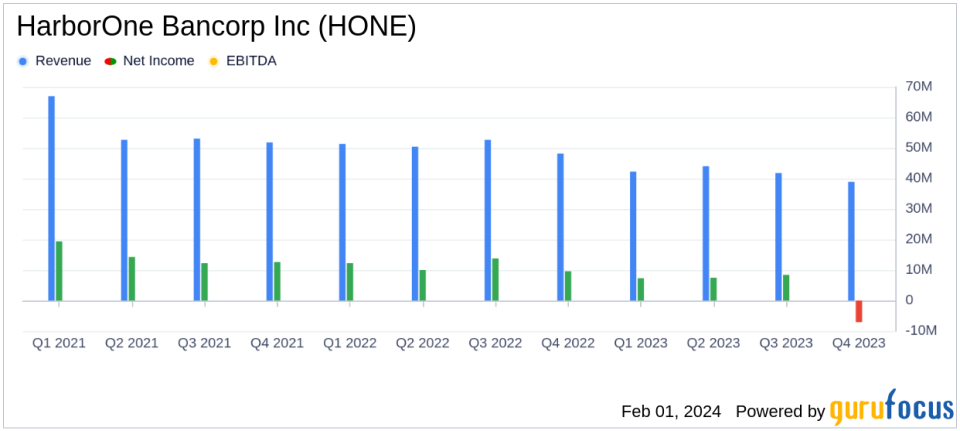

Net Income: Reported a significant decrease of 64.7% year-over-year.

Q4 Performance: Encountered a net loss in Q4 due to mortgage banking headwinds.

Goodwill Impairment: A non-cash charge of $10.8 million impacted earnings.

Net Interest Income: Declined due to higher funding costs and competitive deposit pricing.

Asset Quality: Nonperforming assets increased slightly year-over-year.

Capital Position: Remains strong, exceeding regulatory requirements.

On January 30, 2024, HarborOne Bancorp Inc (NASDAQ:HONE) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The bank holding company, which operates through HarborOne Bank and HarborOne Mortgage, reported a net income of $16.1 million, or $0.37 per diluted share, for the year ended December 31, 2023. This represents a significant decrease of 64.7% compared to the net income of $45.6 million, or $0.97 per diluted share, for the previous year.

HarborOne Bancorp Inc, with its 24 full-service branches and various commercial lending offices in Massachusetts and Rhode Island, faced substantial challenges in its mortgage banking segment. The average residential mortgage rate reached twenty-year highs during 2023, combined with a housing market characterized by low inventory and higher prices, leading to the lowest annual residential mortgage loan origination volume in two decades. These conditions necessitated a full impairment of goodwill at HarborOne Mortgage, amounting to $10.8 million.

Excluding the goodwill impairment charge, net income and diluted earnings per share for the quarter and year ended December 31, 2023, were adjusted to $3.7 million, or $0.09 per diluted share, and $26.9 million, or $0.62 per diluted share, respectively. It's important to note that goodwill impairment is a non-cash charge and does not affect the company's liquidity or regulatory capital ratios.

Financial Performance and Challenges

The company's net interest and dividend income for the fourth quarter was $29.7 million, a decrease from both the preceding quarter's $31.1 million and the prior year's $39.2 million. The tax equivalent interest rate spread and net interest margin for the fourth quarter were 1.56% and 2.23%, respectively, reflecting a higher cost of funding partially offset by increased loan balances and yields.

Noninterest income decreased by 23.2% to $8.9 million for the quarter, mainly due to a decrease in the mortgage servicing rights valuation. HarborOne Mortgage's gain on loan sales was $2.2 million from mortgage loan closings of $124.2 million for the quarter, a decrease from the preceding quarter's $2.7 million in gain on loan sales from mortgage loan closings of $157.6 million.

Total noninterest expense increased by 35.6% to $43.2 million for the quarter, driven by the goodwill impairment charge. Excluding this charge, noninterest expenses were $32.4 million. The company has also taken proactive cost-saving measures, including reductions in force, resulting in a decrease in compensation and benefits expense.

Asset Quality and Balance Sheet

Nonperforming assets were $17.6 million at December 31, 2023, compared to $18.8 million at September 30, 2023, and $14.8 million at December 31, 2022. The allowance for credit losses on loans was $48.0 million, or 1.01% of total loans, at the end of 2023.

Total assets increased year-over-year from $5.36 billion to $5.67 billion, primarily reflecting increases in total loans and cash and cash equivalents. Total deposits were $4.39 billion at the end of 2023, with FDIC-insured deposits comprising approximately 68% of total deposits.

HarborOne Bancorp Inc's capital position remains robust, with stockholders equity totaling $583.8 million at the end of 2023. The company continues to exceed all regulatory capital requirements and is considered well-capitalized.

The company's performance in 2023 was significantly influenced by the challenging conditions in the mortgage banking industry. While HarborOne Bancorp Inc has demonstrated resilience through its relationship bank model and proactive cost-saving measures, the headwinds faced by HarborOne Mortgage have had a notable impact on the company's financial results. Investors and stakeholders will be closely monitoring the company's strategies to navigate the evolving economic landscape and its effects on the banking sector.

Explore the complete 8-K earnings release (here) from HarborOne Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas