Meridian Corp (MRBK) Reports Q4 Earnings Decline and Announces Dividend

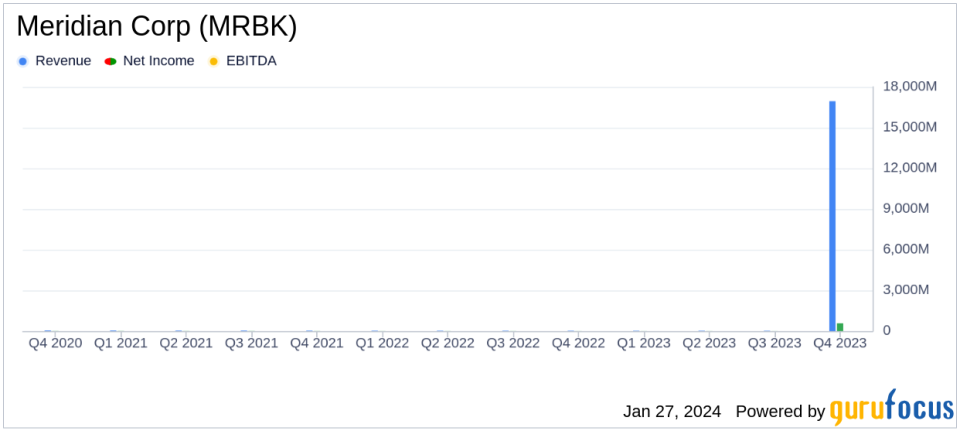

Net Income: Q4 net income decreased to $571 thousand from $4.005 million in Q3.

Diluted EPS: Earnings per share dropped to $0.05 in Q4 from $0.35 in the previous quarter.

Loan Growth: Commercial loans, excluding leases, grew by $15.7 million for the quarter and $114.6 million year over year.

Net Interest Margin: Q4 net interest margin was 3.18%, down from 3.35% for the year.

Dividend: A quarterly cash dividend of $0.125 per common share was declared, payable on February 20, 2024.

Asset Quality: The ratio of non-performing loans to total loans increased to 1.76% at the end of Q4.

Capital Ratios: The Tier 1 leverage ratio for the Bank stood at 9.46% at the end of Q4.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 26, 2024, Meridian Corp (NASDAQ:MRBK) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a full-service state-chartered commercial bank, operates in three business segments: Bank, Wealth, and Mortgage. It primarily generates revenue from its Bank segment, which includes commercial and retail banking, and offers a range of personal, business lending, and deposit services.

Meridian Corp reported a significant decline in net income for the fourth quarter, totaling $571 thousand, a decrease from $4.005 million in the previous quarter. This decline was attributed to an additional provision for a non-performing commercial credit and the impact of historical interest rate rises on its SBA and small-ticket leasing businesses. Despite these challenges, the company experienced a 9% annual loan growth in its core portfolios, reflecting stable business conditions in the Philadelphia metro region.

Financial Performance and Challenges

Meridian Corp's diluted earnings per share (EPS) for Q4 stood at $0.05, down from $0.35 in Q3, and $1.16 for the year, compared to $1.79 in the previous year. The company's pre-tax, pre-provision income for the Bank was $5.8 million for the quarter and $27.8 million for the year. The net interest margin for Q4 was reported at 3.18%, with a loan yield of 7.15%, indicating a decrease from the annual net interest margin of 3.35% and a loan yield of 6.94%.

Christopher J. Annas, Chairman and CEO of Meridian, commented on the quarter's performance, highlighting the impact of higher deposit expenses and the challenging environment created by Federal Reserve interest rate moves. He also noted the downsizing of the mortgage segment to match expected volumes and the ongoing strong demand for housing.

Our continued growth results from being highly visible in our regions, and being the preferred bank in the Delaware Valley. If the forecasted rate declines materialize, the business environment should be robust," said Mr. Annas.

Financial Highlights and Achievements

The company's balance sheet showed an increase in total assets to $2.2 billion as of December 31, 2023, from $2.1 billion at the end of the previous year. The growth in commercial loans and the declaration of a quarterly dividend are indicative of the company's commitment to shareholder returns and its confidence in its business model.

The asset quality summary revealed an increase in the ratio of non-performing loans to total loans, which rose to 1.76% at the end of Q4. The Tier 1 leverage ratio for the Bank was reported at 9.46%, reflecting the bank's capital strength.

Meridian Corp's financial achievements, particularly in loan growth and maintaining a stable Tier 1 leverage ratio, are crucial for the company's sustainability and its ability to weather economic fluctuations. These achievements are particularly important for banks, as they reflect the institution's lending capabilities and financial stability.

Meridian Corp's performance in Q4 demonstrates the challenges faced by financial institutions in a rapidly changing interest rate environment. The company's ability to grow its loan portfolio amidst these challenges suggests resilience and adaptability. However, the decline in net income and net interest margin points to the need for continued vigilance and strategic management to navigate future economic uncertainties.

For more detailed financial information and the full earnings report, investors and interested parties are encouraged to review the complete 8-K filing.

Explore the complete 8-K earnings release (here) from Meridian Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas