Insiders Roundup: Avid Technology, Nebula

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$2,000,000+," the duration to "June 2020" and All Insider Sales to "$2,000,000+."

According to these filters, the following are this past week's most significant trades from company insiders.

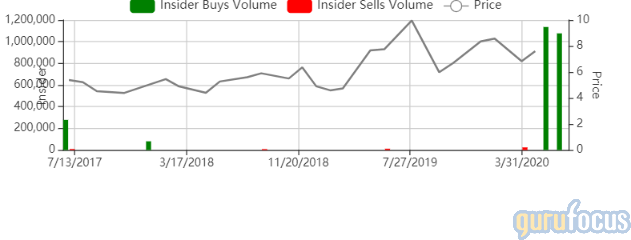

Avid Technology

Christian Asmar, director and 10% owner of Avid Technology Inc. (AVID), bought 1 million shares for an average price of $6.79 on June 2.

The developer and seller of software and hardware for media management has a market cap of $326 million and an enterprise value of $525 million. It has institutional ownership of 33.65% and insider ownership of 14.57%.

Over the past 12 months, the stock has lost 3.6%. As of Friday, it was trading 30.77% below its 52-week high and 59.96% above its 52-week low.

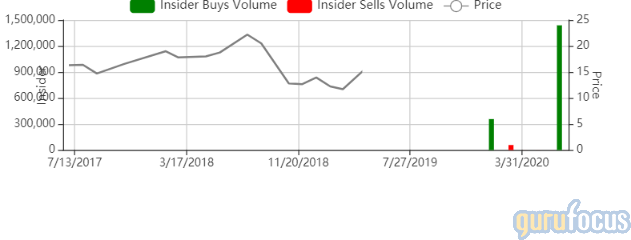

Merus

Biotechnology Value Fund LP bought 1.4 million shares of Merus NV (MRUS) for an average price of $14 per share on June 1.

The biotechnology company has a market cap of $469 million and an enterprise value of $260 million. It has institutional ownership of 15.68% and insider ownership of 0.39%

Over the past 12 months, the stock has gained 20.78%. As of Friday, it was trading 22.86% below its 52-week high and 58.65% above its 52-week low.

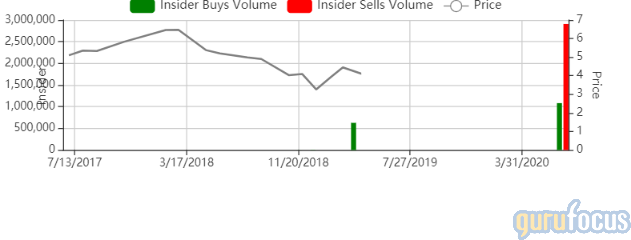

RCM Technologies

Director Roger H Ballou, together with Cheif Financial Officer Kevin D. Miller and Bradley Vizi, bought a combined 1.1 million shares of RCM Technologies Inc. (RCMT) at the average price of $1.20 per share on June 2.

The provider of business technology solutions has a market cap of $21.47 million and an enterprise value of $59.37 million. It has institutional ownership of 14.88% and insider ownership of 14.59%.

Over the past 12 months, the shares have decreased 40%. As of Friday, the stock was trading 54.44% below its 52-week high and 86.27% above its 52-week low.

Nebula

Glazer Capital LLC, 10% owner of Nebula Acquisition Corp. (NEBU), sold 1.1 million shares on June 4 for an average price of $10.25 per share.

The blank check company has a market cap of $352 million and an enterprise value of $351 million. It has institutional ownership of 6.12%.

Over the past 12 months, the stock has gained 1.99%. As of Friday, shares were trading 9.37% below the 52-week high and 9.39% above the 52-week low.

Zscaler

Zscaler Inc. (ZS) CFO Remo Canessa sold 110,000 shares for an average price of $106.90 per share on June 3.

The provider of cloud solutions to protect data and devices has a market cap of $13.45 billion and an enterprise value of $12.98 billion. It has insider ownership of 1.58% and institutional ownership of 34.27%.

Over the past 12 months, the stock has risen 42%. As of Friday, shares were trading 8.59% below the 52-week high and 194.43% above the 52-week low.

Copart

Willis J. Johnson, chairman of the board of Copart Inc. (CPRT), sold 611,079 shares for an average price of $89.68 per share on June 3.

The provider of online auctions has a market cap of $21.07 billion and an enterprise value of $21.28 million. It has insider ownership of 4.14% and institutional ownership of 60.24%.

Over the past 12 months, the stock has gained 24%. As of Friday, shares were trading 14.44% below the 52-week high and 61.14% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas