Organon & Co (OGN) Q1 2024 Earnings: Exceeds Revenue Expectations, Aligns with EPS Projections

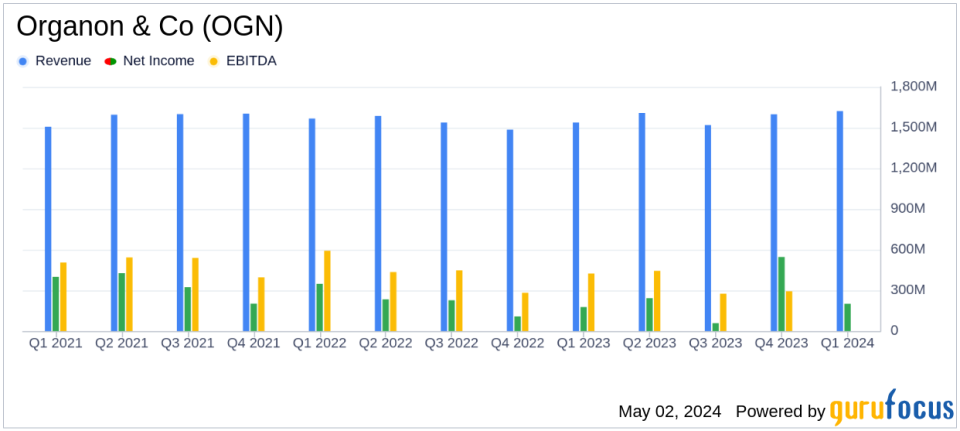

Revenue: Reported at $1,622 million for Q1 2024, marking a 5% increase year-over-year and surpassing the estimated $1,563.20 million.

Net Income: Achieved $201 million, up 14% from the previous year and exceeding the estimate of $189.92 million.

Earnings Per Share (EPS): Recorded at $0.78, falling short of the estimated $0.93.

Gross Margin: Declined to 59.0% from 62.3% year-over-year, reflecting higher material and distribution costs due to inflation and unfavorable product mix.

Biosimilars Revenue: Grew significantly by 46% to $170 million, driven by strong demand for Ontruzant and Renflexis.

Womens Health: Revenue increased by 11% to $422 million, fueled by robust sales of Nexplanon and Jada systems.

Dividend: Announced a quarterly dividend of $0.28 per share, payable on June 13, 2024.

On May 2, 2024, Organon & Co (NYSE:OGN) disclosed its financial results for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a total revenue of $1,622 million, surpassing the analyst's expectation of $1,563.20 million. However, the earnings per share (EPS) stood at $0.78, aligning closely with the estimated $0.93.

Organon & Co is a global healthcare company focused on improving the health of women through its diverse portfolio in women's health, biosimilars, and established brands. With a significant presence in Europe, Canada, the United States, Asia Pacific, and Japan, the company generates most of its revenue from its Established Brands portfolio.

Financial Highlights and Strategic Insights

Organon's revenue growth was driven by a robust performance in its Women's Health and Biosimilars segments. Women's Health saw an 11% increase, largely due to strong sales of Nexplanon and the Jada system. Biosimilars grew by an impressive 46%, with significant contributions from Ontruzant and Hadlima. Despite these gains, challenges such as generic competition impacting NuvaRing sales and a flat performance in Established Brands indicate areas needing strategic focus.

The company's net income for Q1 2024 was $201 million, a 14% increase from $177 million in Q1 2023. The non-GAAP adjusted net income also saw a 14% rise to $315 million. Despite these increases, the gross margin declined to 59.0% from 62.3% in the previous year, reflecting unfavorable product mix and inflationary pressures.

Operational Efficiency and Future Outlook

Organon's operational strategies include cost containment measures, particularly in research and development, which have helped maintain a stable non-GAAP adjusted EBITDA margin of 33.2%. The company reaffirmed its full-year 2024 revenue guidance of $6.2 billion to $6.5 billion and expects its non-GAAP adjusted EBITDA margin to remain between 31.0% and 33.0%.

Looking ahead, Organon is poised to leverage its strong cash flows from existing products to invest in innovation and growth opportunities, particularly in women's health and biosimilars. The company's global footprint and commercial capabilities are expected to support these strategic initiatives and address the competitive challenges in the pharmaceutical industry.

Investor and Market Implications

Organon's Q1 performance, characterized by revenue growth and alignment with EPS estimates, reflects a solid start to 2024. Investors should note the company's strategic positioning in women's health and biosimilars, sectors with potential for significant growth. However, the challenges posed by competitive pressures and market dynamics will require continuous strategic evaluation. Organon's commitment to maintaining robust financial health and delivering shareholder value is evident in its stable dividend payout and comprehensive capital allocation strategy.

For detailed financial figures and future projections, stakeholders and potential investors are encouraged to review the full earnings report and participate in upcoming investor events detailed on Organon's Investor Relations website.

Explore the complete 8-K earnings release (here) from Organon & Co for further details.

This article first appeared on GuruFocus.

Yahoo Finanzas

Yahoo Finanzas