Exploring Dividend Stocks With Bank Of Nanjing And Two Others

As global markets navigate through varying economic signals, China has recently implemented significant measures to support its troubled housing sector, reflecting proactive steps to stabilize the economy amidst ongoing challenges. In this context, exploring dividend stocks like Bank of Nanjing becomes particularly relevant as investors look for opportunities that might offer steady returns in a fluctuating market environment.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.27% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.50% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.16% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.36% | ★★★★★★ |

Jiangsu Yanghe Brewery (SZSE:002304) | 4.88% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.46% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.29% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.03% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.90% | ★★★★★★ |

Click here to see the full list of 189 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bank of Nanjing

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Nanjing Co., Ltd. operates in China, offering a range of financial products and services, with a market capitalization of approximately CN¥104.47 billion.

Operations: Bank of Nanjing Co., Ltd. generates its revenues by providing a variety of financial products and services across China.

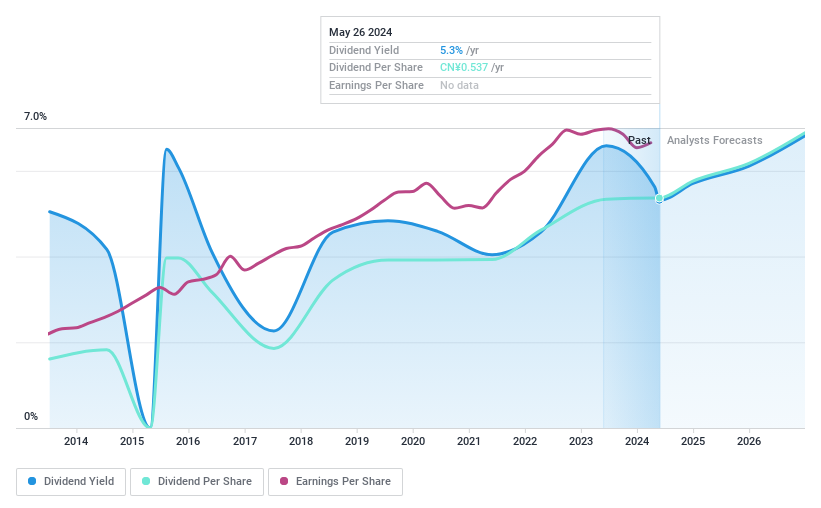

Dividend Yield: 5.3%

Bank of Nanjing, trading at 58.5% below estimated fair value, offers a dividend yield of 5.31%, ranking in the top 25% in the Chinese market. Despite a reasonably low payout ratio of 31.4%, ensuring current and forecasted earnings coverage, its dividend history has been unstable with significant volatility over the past decade. Recent financials show a Q1 net income increase to CNY 5.71 billion from CNY 5.43 billion year-over-year, suggesting potential earnings growth despite past dividend inconsistencies.

Get an in-depth perspective on Bank of Nanjing's performance by reading our dividend report here.

Our valuation report here indicates Bank of Nanjing may be overvalued.

Shanxi Coking Coal Energy Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanxi Coking Coal Energy Group Co., Ltd. operates in the coal production industry and has a market capitalization of approximately CN¥63.30 billion.

Operations: Shanxi Coking Coal Energy Group Co., Ltd. does not provide detailed information on its revenue segments in the provided text.

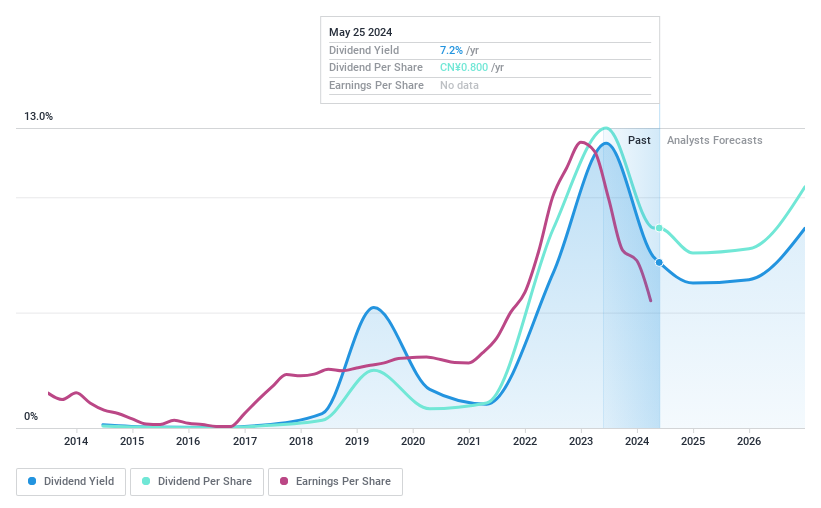

Dividend Yield: 7.2%

Shanxi Coking Coal Energy Group's dividend yield of 7.17% positions it well within the top quartile of Chinese dividend stocks, though its history reveals a pattern of volatility and unreliability in payouts over the last decade. Despite a high payout ratio of 85.8%, both earnings and cash flows substantiate these dividends, with recent financials indicating a downturn; Q1 sales dropped to CNY 10.55 billion from CNY 14.75 billion year-over-year, alongside a significant reduction in net income from CNY 2.47 billion to CNY 950.19 million, reflecting broader operational challenges.

Zhejiang Wellsun Intelligent TechnologyLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Wellsun Intelligent Technology Co., Ltd. operates in the technology sector and has a market capitalization of approximately CN¥5.44 billion.

Operations: Zhejiang Wellsun Intelligent Technology Co., Ltd. has not provided detailed information on its revenue segments.

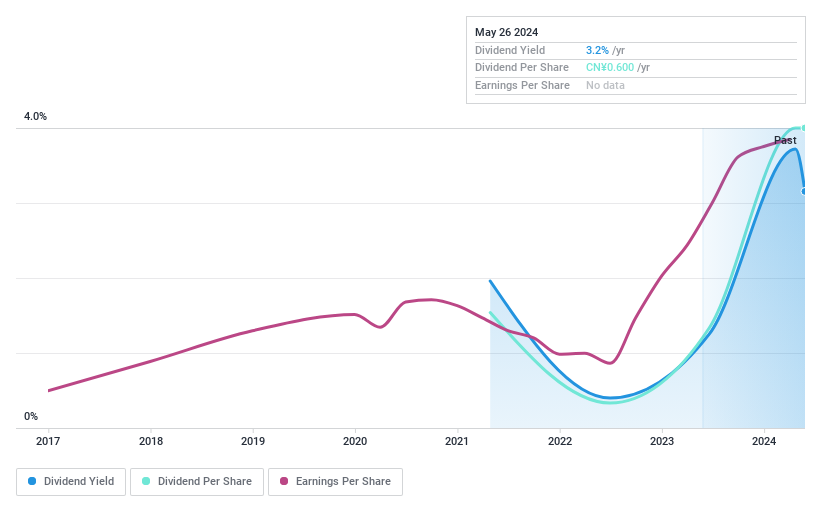

Dividend Yield: 3.2%

Zhejiang Wellsun Intelligent Technology Co.,Ltd. has a relatively young dividend history with only three years of payments, which have shown growth but also volatility. The company's recent dividend declaration was CNY 6 per 10 shares for 2023, reflecting an upward adjustment. Despite its share price volatility, dividends seem sustainable with a coverage by earnings at a payout ratio of 48% and cash flows at 59.8%. Additionally, the firm's earnings rose by over 55% last year, supporting its dividend increases amidst fluctuating market conditions.

Turning Ideas Into Actions

Unlock our comprehensive list of 189 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601009 SZSE:000983 and SZSE:300882.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finanzas

Yahoo Finanzas