IonQ Stock: Buy, Sell, or Hold?

The quantum computing technology from IonQ (NYSE: IONQ) has the potential to revolutionize everything from machine learning to optimization, simulations, and cryptography. There's a lot of excitement in this field, which many see as the next step to tackling complex problems more effectively than even the most advanced accelerated computers.

On the other hand, shares of IonQ have been extremely volatile, down more than 30% this year. The market appears concerned about the company's lack of profitability and its pricey valuation.

IonQ has many strengths and weaknesses as an investment opportunity. Let's assess the reasons to buy, sell, and hold the stock.

Massive growth in 2024

The good news is that IonQ is off to a strong start in 2024 in terms of its operating momentum.

For the first quarter, IonQ reported $7.6 million in revenue, an increase of 77% year over year. The company notes that several public and private institutions signed up as new clients to utilize IonQ's quantum computer offerings.

Oak Ridge National Laboratory, a federally funded research and development center, is exploring how the technology can be used to optimize the U.S. power grid. In Germany, Deutsches Elektronen-Synchrotron (DESY) is utilizing IonQ's Aria system to manage airport flight gate assignments.

These types of contracts highlight the growing interest in quantum computing with real-world applications. The company reaffirmed its full-year revenue target between $37 million and $41 million, marking a ramp-up compared to the $22 million result in 2023.

Maybe the biggest development this year is the company's progress toward delivering the first IonQ Forte Enterprise system for a customer in Basel, Switzerland. Forte is the company's highest-performance computer designed to integrate into standard data center infrastructure.

In February, IonQ completed the construction of its new dedicated manufacturing facility outside of Seattle. The site marks a milestone for the company in its ability to deliver a commercial solution at scale focused on the production of Forte and the IonQ Tempo systems. This will be a growth driver into 2025 and beyond.

Investors who are confident in this long-term runway could see the stock as a buy, although other factors are also important to consider.

Profitability remains elusive

As strong as the growth trends have been, it's going to take much more from IonQ over the next several years to address the main concern when looking at the stock -- the company's large recurring losses. Quantum computing may be the future, but it's going to require significant spending toward research and development for IonQ's vision to become a reality.

In the first quarter, IonQ's negative adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $27 million widened from the $15.9 million loss in Q1 2023. Management anticipates an adjusted EBITDA loss of around $110.5 million for the full year 2024.

Favorably, its $434 million in cash, cash equivalents, and investments supports some measure of financial flexibility. Still, it's fair to question how long that will last with the cash position likely being chipped away in each quarter going forward.

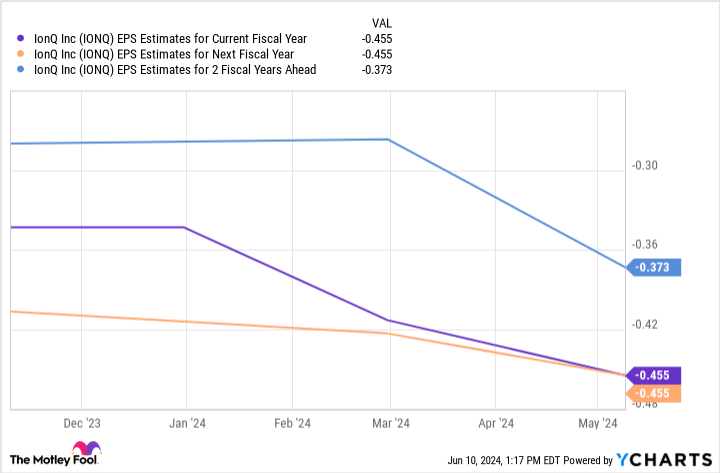

According to consensus estimates, the company is expected to remain in the red over the next three years. It's still unclear when the commercial opportunity will translate into a sustainable financial model.

The decision

With the stock commanding a current $1.7 billion market capitalization, shares are trading at 43 times management's 2024 revenue guidance. This is an objectively expensive premium for any company, particularly one with negative free cash flow and widening losses. At that multiple, the market is pricing in growth over the next decade that nearly requires a leap of faith into quantum computing that is highly speculative based on today's data.

Ultimately, I'd lean on a sell or hold rating for IonQ but otherwise recommend investors simply avoid the stock given its high risk. Weaker-than-expected results through the next few quarters could lead to a bigger sell-off. Shares can certainly rally from here, but the financial headwinds will likely keep shares volatile.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $746,217!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

IonQ Stock: Buy, Sell, or Hold? was originally published by The Motley Fool

Yahoo Finanzas

Yahoo Finanzas